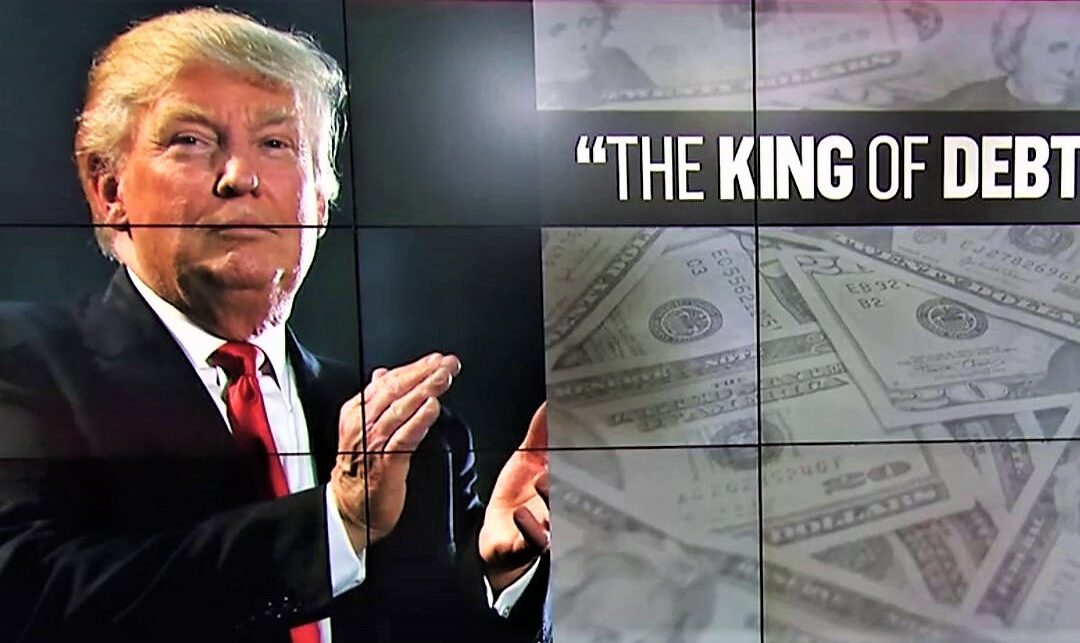

Donald Trump once proclaimed himself the “king of debt,” and that may explain why his administration reported a river of red ink today.

The federal deficit for the 2019 budget year surged 26% from 2018 to $984.4 billion — its highest point in seven years.

The gap is widely expected to top $1 trillion in the current budget year and likely remain there for the next decade.

The year-over-year widening in the deficit reflected such factors as revenue lost from the 2017 Trump tax cut and a budget deal that added billions in spending for military and domestic programs.

But does Trump really care?

“I’m the king of debt. I love debt,” Trump said in 2016, seemingly trying to explain the comfort level he has with debt after a long business career that included four bankruptcy filings by his companies.

Trillion-dollar deficits are all part of his “strategy to turbocharge U.S. economic policy ahead of the next election,” according to Greg Valliere, chief U.S. strategist at AGF Investments.

“He’s looking like a Keynesian (or a proponent of Modern Monetary Theory) as he agrees to enormous new spending, confirming that neither he nor National Economic Council Director Larry Kudlow ever cared about deficits. In private, they dismiss concern about red ink—and why not? There’s an insatiable demand for Treasuries,” Valliere writes in a client note.

Forecasts by the Trump administration and the Congressional Budget Office project that the deficit will top $1 trillion in the 2020 budget year, which began Oct. 1.

And the CBO estimates that the deficit will stay above $1 trillion over the next decade.

Those projections stand in contrast to President Donald Trump’s campaign promises that even with revenue lost initially from his tax cuts, he could eliminate the budget deficit with cuts in spending and increased growth generated by the tax cuts.

The deficit has been rising every year for the past four years, including when Republicans controlled both the House and Senate.

It’s a stretch of widening deficits not seen since the early 1980s, when the deficit exploded with President Ronald Reagan’s big tax cut.

For 2019, revenues grew 4%.

But spending jumped at twice that rate, reflecting a deal that Trump reached with Congress in early 2018 to boost spending.

Fiscal hawks have long warned of the economic dangers of running big government deficits. Yet the apocalypse they fear never seems to happen, and the government just keeps on spending.

There have been numerous attempts by presidents after Reagan to control spending.

President George H.W. Bush actually agreed to a tax increase to control deficits when he was in office, breaking his “Read my lips” pledge not to raise taxes.

And a standoff between President Bill Clinton and House Speaker Newt Gingrich did produce a rare string of four years of budget surpluses from 1998 through 2001.

In fact, the budget picture was so bright when George W. Bush took office in 2001 that the Congressional Budget Office projected that the government would run surpluses of $5.6 trillion over the next decade.

That didn’t happen.

The economy slid into a mild recession, Bush pushed through a big tax cut and the war on terrorism sent military spending surging. T

hen the 2008 financial crisis erupted and triggered a devastating recession. The downturn produced the economy’s first round of trillion-dollar deficits under President Obama and is expected to do so again under Trump.

Federal Reserve Chairman Jerome Powell says the day of reckoning is still coming but isn’t here yet.

Most analysts think any real solution will involve a combination of higher taxes and cost savings in the government’s huge benefit programs of Social Security and Medicare.