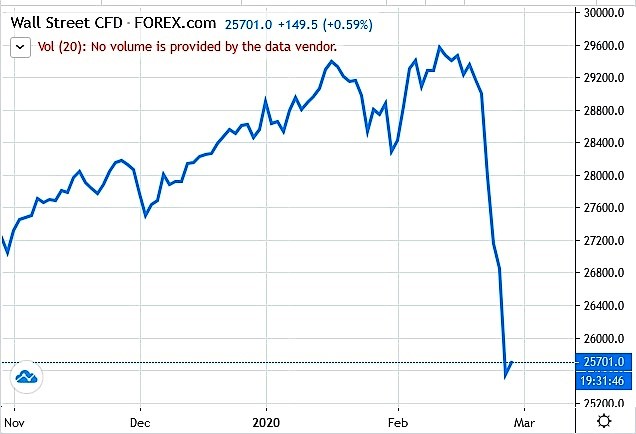

U.S. stock indexes plunged dramatically yet again today, as the rapid spread of the coronavirus outside China deepens investor worries about growth and corporate earnings.

The Dow Jones Industrial Average plummeted 1,190.95 points, or 4.42 percent, to 25,766.64, the largest one-day point drop in history. It comes during the quickest market plunge on a percentage basis since the financial crisis of October 2008.

The Dow, S&P 500 and Nasdaq all closed more than 10 percent below their recent highs.

That means the market is officially in a correction, which is a normal phenomenon that analysts have said was long overdue.

At their heart, stock prices rise and fall with the profits that companies expect to make — and Wall Street’s expectations for profit growth are sinking as more companies warn that the virus outbreak will hit their bottom lines.

Adding to worries, the U.S. Centers for Disease Control and Prevention confirmed an infection in California in a person who reportedly did not have relevant travel history or exposure to another known patient.

‘In the recent week, markets have come to realize that the outbreak is much worse and are now realistically pricing in the impact of the virus on the economy,’ said Philip Marey, senior U.S. strategist at Rabobank.

‘In that sense it’s a bit of a catching up from the relative optimism that was there in the beginning when markets thought (the virus) will be contained to China with some minor outbreak outside.’

Rising fears of a pandemic, which U.S. health authorities have warned is likely, have erased about $1.84 trillion off the benchmark S&P 500 this week alone.

Industry analysts and economists continued to sound the alarm as they assessed the impact of the coronavirus, with Goldman Sachs saying U.S. companies will generate no earnings growth in 2020.

Apple and Microsoft, two of the world´s biggest companies, have already said their sales this quarter will feel the economic effects of the virus.

Microsoft’s stock lost 2.8 percent after it told investors that the virus will hurt revenue from its Windows licenses and its Surface devices.

American Airlines plunged 8.5 percent as airlines continue to feel pain from disrupted travel plans and suspended routes.

Delta Airlines, which is reducing flights to South Korea because of the outbreak in that nation, fell 4.5 percent.

Bank of America slashed its world growth forecast to the lowest level since the peak of the global financial crisis.

Financial warnings also came from Budweiser maker InBev and cloud-computing company Nutanix.

The virus has now infected more than 82,000 people globally and is worrying governments with its rapid spread beyond the epicenter of China.

The price of crude oil fell 4.7 percent. The price has been falling sharply as investors anticipate that demand for energy will wane as the economy slows.

Bond yields continued sliding as investors shifted money into lower-risk assets.

The yield on the 10-year Treasury fell further into record low territory, to 1.28% from 1.31% late Wednesday.