It’s a case of pure big business greed during a pandemic.

Companies with thousands of employees, past penalties from government investigations and risks of financial failure even before the coronavirus walloped the economy were among those receiving millions of dollars from a relief fund that Congress created to help small businesses through the crisis.

The Paycheck Protection Program was supposed to infuse small businesses with $349 billion in emergency loans that could help keep workers on the job and bills paid on time.

But at least 75 companies that received the aid were publicly traded, the AP found, and some had market values well over $100 million.

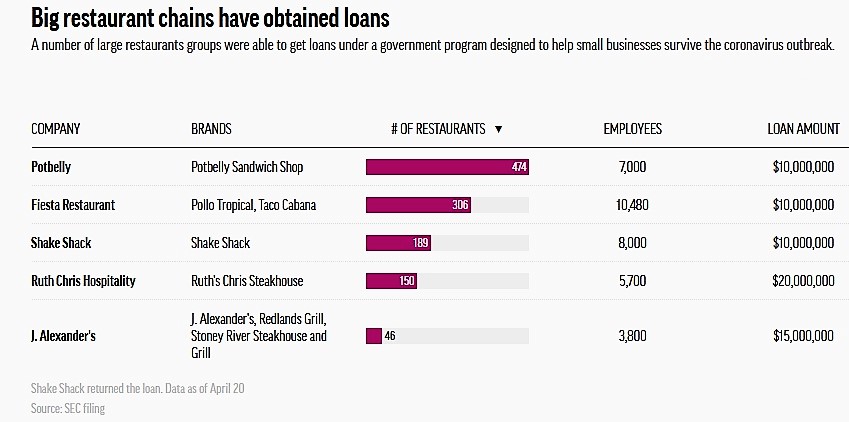

The program was designed for companies with less than 500 employees, but restaurants and hotels were exempt from that limit if they had less than 500 employees per location.

The owners behind large restaurants chains like Potbelly, Ruth’s Chris Steak House and Taco Cabana were able to qualify despite employing thousands of workers and get the maximum $10 million in loans.

Shake Shack, after revealing it had been granted a $10 million loan in a regulatory filing on Friday, announced Sunday that it would return the money after facing public backlash.

In a statement, Shake Shack CEO Randy Garutti and its founder Danny Meyer said, “It’s inexcusable to leave restaurants out (of the PPP) because no one told them to get in line by the time the funding dried up. That unfairly pits restaurants against restaurants.”

Funding for the PPP ran out last week, but today Democrats and Republicans in Congress reached a deal to add $310 billion in small-business loans.

Senate Minority Leader Chuck Schumer claimed that of that funding, $125 billion will be sent ‘exclusively to the unbanked, to the minorities, to the rural areas, and to all of those little mom and pop stores that don’t have a good banking connection and need the help.’

Overall, 25 percent of the public companies identified in the AP analysis as receiving PPP funds had warned investors months ago – while the economy was humming along – that their ability to remain viable was in question.

By combing through thousands of regulatory filings, the analysis identified the 75 companies as recipients of a combined $300 million in low-interest, taxpayer-backed loans.

Eight companies, or their subsidiaries, received the maximum $10 million.

The size of the typical loan nationally was $206,000, according to U.S. Small Business Administration statistics. If companies meet benchmarks such as keeping employees on payroll for eight weeks, the SBA will forgive the loans.

The public companies identified in the analysis is a fraction of the 1.6 million loans that banks approved before the program was depleted last week, but it is the most complete public accounting to date.

Many restaurants are scrambling to shore up their finances as customers obey stay-at-home orders.

U.S. restaurant sales were down 43% the week ending April 12, according to NPD Group, a data and consulting firm.

The drop-off has been sharpest for sit-down restaurants that have closed their dining rooms.