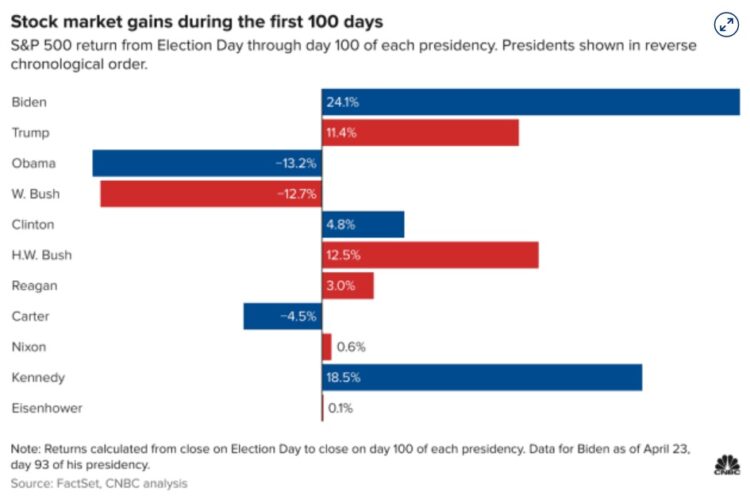

So far in his young presidency, President Biden has been one of the best friends the stock market has ever had.

Better, in fact, than any president before him going back to at least the 1950s and the Dwight Eisenhower administration, as the 46th chief executive has witnessed an unprecedented growth on Wall Street in his first 100 days in office.

How long that cozy relationship will last is about to be determined, as investors have to digest a slew of potential obstacles from tax policy, regulations associated with Biden’s ambitious climate agenda, and the threat of overheating in an economy already on fire.

But so far, investors have shown no hesitance in making huge bets on corporate America.

“Biden’s first 100 days have already delivered the strongest post-election equity returns in at least 75 years, due to record fiscal stimulus and despite heavy use of Executive Orders,” JPMorgan Chase strategist John Normand said in a note. The results are “not bad for some [former President Donald] Trump labeled as Sleepy Joe during the campaign.”

Indeed, Biden’s results have been staggering so far.

The S&P 500 has risen 24.1% since Inauguration Day – technically 103 days ago – with numbers that easily trounce any of his predecessors.

The only administration going back to 1953, or the beginning of Eisenhower’s term, to rival Biden’s were those of John F. Kennedy, who saw an 18.5% rise during the same period.

Even Trump, who often touted how well stocks were doing, saw just an 11.4% rise for the first 100 days.

To be sure, judging results that early in a presidency is tricky.

In Biden’s case, it’s especially difficult to gauge whether the market was reacting to him specifically or simply continuing to ride the steam locomotive that began in late March 2020 and has shown only sporadic signs of slowing down since.

“Anyone that became president this year was going to have a pretty significant tailwind,” said Art Hogan, chief market strategist at National Securities. “You’re coming into a point where you had to just not mess things up, and hopefully improve on what it was you needed to get done.”

No president, in fact, had a tailwind comparable to what Biden was handed in January.

Congress already had appropriated more than $3 trillion in stimulus and the Federal Reserve had relaxed policy to the loosest point in the central bank’s history.

All told, more than $5.3 trillion has been spent on Covid-related relief efforts, and the Fed’s bond purchases have nearly doubled its balance sheet to just shy of $8 trillion.

With possibly trillions more coming in spending on infrastructure, a term that congressional Democrats have paint with a generously broad brush, that gives forward-looking investors even more reason to plow money into the market.

On top of that, the U.S. is still vaccinating about 3 million people a day, adding hopes that growth will continue as more of the economy comes back to life ahead.

“It will be intriguing to see what the next 100 days looks like,” Hogan said. “There’s a significant tailwind for reopening. The tug-of-war between the virus and vaccine is finally being won by the vaccine.”